Jaguar Land Rover – Between A Rock And A Hard Brexit

05 August 2019

Jaguar Land Rover - Between A Rock And A Hard Brexit

George Flynn, Everest Research, 6 August 2019

-

Jaguar Land Rover’s (JLR) results for Q1 2020 were weak. EBIT margin at -5.5% was 180 basis points lower yoy. Adjusted leverage stood at 2.95x vs 1.12x at Q1 2019. FCF excluding the draw on the receivables finance facility was c. -£1bn which was c. £650mm less negative yoy. EBIT margin was impacted by the 11.6% decline in volumes yoy, increased marketing spend as excess inventory was moved in China and warranty expenses. Capex is guided to be c. £3.8bn for FY 2020

In terms of “new news” our highlights are below

-

#1 China sales. Retail Chinese sales were down 29% YoY. JLR believe they are through/at the yoy trough in volumes and expect that July retail sales will be up yoy. JLR’s results call came on the same day that the Chinese Association of Automobile Manufacturers cut its forecast for 2019 to -5% from flat

-

China is a key market for JLR – the run out of the Evoque and Discovery Sport ahead of new models / refreshes has had a huge impact on sales volumes, with the Chinese being one of the largest buyers. As a future growth driver, we note estimates in the press that Chinese auto sales growth next year could be just 1 to 2%. The Chinese market remains highly competitive and, whilst JLR is likely to have a better inventory position in the region in H2 2020, we expect pricing power to remain muted

-

The real litmus test for JLR’s volumes in China, which management guide to be higher in H2 2020, will be the performance of the new Evoque and refreshed Discovery Sport in China. In our deep dive report from July (see here), we analysed the positive impact of volume increases stemming from the introduction of the refreshed Evoque and Discovery Sport and new Defender into the range

-

Whilst new and updated name plates have a positive impact on volumes, many OEMs have been holding off product launches until the new WLTP emissions standards come fully into effect. This means that 2020-21 could see an increased amount of competition, especially as the number of electric luxury SUVs is set to increase

-

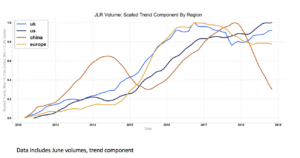

We examine the seasonality and trend of JLR’s sales volumes in our report. The chart below summarises the trend in sales by region. We index the trend component at 1 to get a clear sense of sales momentum. Chinese sales momentum has fallen steeply, due to the confluence of run-out of models, fierce competition and an excess of inventory

-

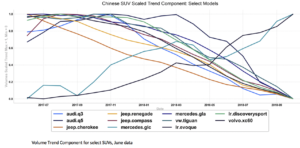

It is important to note that the Chinese sales decline has been particularly severe in the premium SUV segment and JLR is not alone. Below is another figure from our report where we look at the trend component for select SUV models. Volvo and Mercedes are relative outperformers, although both have reported significant declines in earnings this quarter with Volvo citing China as a main driver of margin decline

-

Clearly, a stabilisation in terms of volumes is much needed for JLR and the industry. We caution on calling the bottom on one month’s sales data. LMC Automotive estimate that global excess automotive production capacity is c 34%, with most of any new capacity being built in China. This does not bode well

-

#2 Quality performance. Management called out their performance in JD Power’s quality surveys – this is something we looked at in some detail in our note. Our conclusion, looking at the historic figures, was that JLR has improved and in some cases has ranked above higher volume premium players. We concluded that the quality issues were over attributed in explaining the decline in volumes in China, although admit it is impossible to quantify this

-

#3 EBIT guidance. EBIT is likely to be at the low end of management’s guidance for FY 2020 at 3%. This comes as little surprise as it will take time for further cost savings to kick in, competition remains tough and operating leverage has yet to be fully addressed. In our note we look at JLR’s EBIT guidance and put it in the context of peers and look at why it is hard for near term cashflows to contribute positively to firm value

-

#4 Export Finance Facility. The £625mm Export Finance Facility is unsecured, can be used for general corporate purposes and is not tied solely to the production of Electric Vehicles. Management also hinted at raising additional funds from an additional Export Finance Facility. One of the key value drivers for us is JLR’s ability to access the unsecured market. Near term maturities are funded, but capex commitments mean that JLR must spend and will need to address coming negative cash flow

-

We think keeping manufacturing in the UK is a real win for local jobs. We estimate though, that wages at the Slovakian Nitra plant could be around half those in the UK. Given operating leverage we think moving capacity to Nitra could help cash flow. Our base case remains for the company to “muddle through”. However, a large part of our analysis is on the potential for downside – which takes us to our fifth point

-

#5 Brexit. One of the questions we receive from investors is “why the focus on valuations?”. The answer is that whilst we weight 82.5% of our Scenario analysis to base and upside cases, 17.5% focusses on the downside risks. This downside risk, should it crystallise, would likely have a significantly negative impact on JLR’s bond prices

-

The perceived odds of a no-deal Brexit will likely drive investors’ decisions to hold JLR or not. An orderly Brexit would be far less damaging, but the SMMT does not see a post-Brexit trade model that fully meets the industry’s needs in any event

-

JLR’s press release on 4/7/19 put the potential cost of Brexit for the firm at £1.2bn, with Ralf Speth (CEO) suggesting that a “no-deal” Brexit could cost the company £60mm a day, should just in time inventory manufacturing be interrupted. Clearly these are “worst case” scenario numbers, with the company acting to mitigate the impact ahead of 31 October. The good news is that JLR has stated it is only focusing on two Brexit scenarios, an orderly Brexit and No Deal Brexit. Revoke is off the table

-

In summary, we remain negative on JLR’s debt despite our view that the company’s turnaround plan is credible. Cash flow is unlikely to allow for meaningful deleveraging. Being stuck between a "Rock and a hard Brexit", the best investors can hope for is a slow improvement in the context of an industry under pressure and near term negative free cash flow. At worst, they may experience a tail event that could severely impact EBITDA, FCF, leverage and liquidity

To get access to a sample of Everest’s JLR report click here and complete the sample download form at the bottom of the page from this link

Contact George Flynn at Everest Research to discuss: [email protected]

Everest Research - Deep dive high yield research, distressed debt research and independent equity research

Categories

Recent Blogs

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 3 March 2020 We published a deep dive last week on Selecta, the European unattended self-service retail market leader, and now see an attractive opportunity to go long risk via both the Senior Secured Notes (SSNs) and 5 …

03 March 2020

Read

OHL. Take Profits Following FY 19 Results

OHL. Take Profits Following FY 19 Results James Moylan & Rupesh Tailor, Everest Research, 28 February 2020 FY 19 results saw negative valuation adjustments on key assets we expect to be sold (Old War Office, London) and alternatively monetised (Canelejas, Madrid) and ongoing uncertainty on the ownership structure. Whilst we remain constructive on OHL’s turnaround (of which there were positive …

28 February 2020

Read

Aldesa. China Railway To Take 75% Stake. CoC Put At 101

Aldesa. China Railway To Take 75% Stake. CoC Put At 101. Buy James Moylan & Rupesh Tailor, Everest Research, 27 December 2019 Aldesa announced late yesterday that, on 25/12/19, it “entered into an investment agreement with CRCC International Investment Group (CRCCII), a wholly-owned subsidiary of China Railway Construction Corporation Limited (CRCC)”, one of the largest construction companies in the world. …

27 December 2019

Read

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 30 October 2019 According to the local newspaper “La Gazzetta di Mantova” (see here), Pro-Gest has been granted a further extension by the Province of Mantua to file its counter-arguments to the rejection of its application for an …