Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

03 March 2020

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 3 March 2020

- We published a deep dive last week on Selecta, the European unattended self-service retail market leader, and now see an attractive opportunity to go long risk via both the Senior Secured Notes (SSNs) and 5 year CDS. See our initiation Memo for more detail

- Selecta’s Senior Secured Notes (SSNs) and CDS recent spread widening reflects the uncertainty around the extent and duration of its exposure to coronavirus (COVID-19) which will likely result in lower sales due to fewer hours worked at the office and lower footfall in public locations where Selecta’s PoS are located

- Absent a severe escalation of the epidemic in Europe, we believe Selecta will register only a slight negative impact in Q1 20, potentially continuing for several quarters. We view Selecta’s liquidity profile as robust and sufficient to withstand a prolonged crisis. The coronavirus impact on the unattended self-service retail sector could even turn out to be an opportunity in terms of increased potential for bolt-on acquisitions on favourable terms of the most exposed and weakest players

- In relative terms, Selecta’s CDS and SSNs slightly underperformed the relevant benchmarks across CDS and cash markets respectively over the past week. Even with the refinancing and IPO window closed in the short-term, which could have represented an exit for current bondholders, in absolute terms we think the market is not appreciating Selecta’s resilient business and valuation even in our bear case scenario (which does not include a COVID-19 epidemic) which shows 100% recovery on SSNs

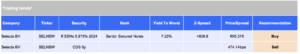

- Following our Avoid recommendation on 26.02.20 on both the SSNs at a price of 100.125 and on the 5 year CDS at a spread of c. 345bps, we now move to Buy on the SSNs and “take” a new 2% long “position” in our model “portfolio” in Selecta’s € SSNs 5.875% 2024 at a price of 95.375 (good upside to the call at c. 103 if markets re-open). We move to a Sell recommendation (i.e. long risk) on Selecta 5 year CDS and “sell” Selecta 5 year CDS for 2% of model portfolio AUM at a spread of c. 474bps, motivated by the higher upside potential offered by selling CDS (as compared to buying SSNs) in the event that a CDS orphaning arises following an IPO as per our initiation Memo

- Close on 2/3/20

Contact Rupesh Tailor at Everest Research to discuss: [email protected]

Everest Research - Deep dive high yield research, distressed debt research and independent equity research

Categories

Recent Blogs

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 3 March 2020 We published a deep dive last week on Selecta, the European unattended self-service retail market leader, and now see an attractive opportunity to go long risk via both the Senior Secured Notes (SSNs) and 5 …

03 March 2020

Read

OHL. Take Profits Following FY 19 Results

OHL. Take Profits Following FY 19 Results James Moylan & Rupesh Tailor, Everest Research, 28 February 2020 FY 19 results saw negative valuation adjustments on key assets we expect to be sold (Old War Office, London) and alternatively monetised (Canelejas, Madrid) and ongoing uncertainty on the ownership structure. Whilst we remain constructive on OHL’s turnaround (of which there were positive …

28 February 2020

Read

Aldesa. China Railway To Take 75% Stake. CoC Put At 101

Aldesa. China Railway To Take 75% Stake. CoC Put At 101. Buy James Moylan & Rupesh Tailor, Everest Research, 27 December 2019 Aldesa announced late yesterday that, on 25/12/19, it “entered into an investment agreement with CRCC International Investment Group (CRCCII), a wholly-owned subsidiary of China Railway Construction Corporation Limited (CRCC)”, one of the largest construction companies in the world. …

27 December 2019

Read

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 30 October 2019 According to the local newspaper “La Gazzetta di Mantova” (see here), Pro-Gest has been granted a further extension by the Province of Mantua to file its counter-arguments to the rejection of its application for an …