Hoist Q4 / FY 2018 Results – Substantially Deteriorated Purchasing Economics In 2018

20 February 2019

Hoist Q4 / FY 2018 Results – Substantially deteriorated debt purchasing economics in 2018

Rupesh Tailor, Everest Research, 20 February 2019

- Key observation #1 - Remaining 180 month gross money multiple of < 1.3x on 2018 portfolio purchases implies negative remaining lifetime cash generation on these purchases

- Key observation # 2 - Hoist potentially faces an effective c. 8.3x increase in capital requirements from 2022 on new consumer unsecured NPL portfolios purchased from Q2 2019. Clearly the company expects to take mitigating actions

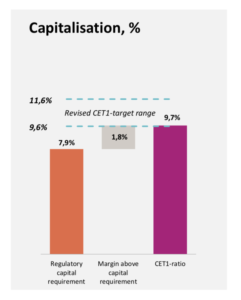

- Key observation #3 - Hoist's reduction in headroom in capital over its regulatory requirement (2018 CET1 ratio of c. 9.7% vs requirement of c. 7.9%) as a result of the increase in risk weight from 100% to 150% (implemented in late 2018) on consumer unsecured NPLs already owned has caused Hoist to evaluate securitisation of portfolios as a mitigating action. This would further subordinate senior unsecured bondholders (who are already subordinated to depositors)

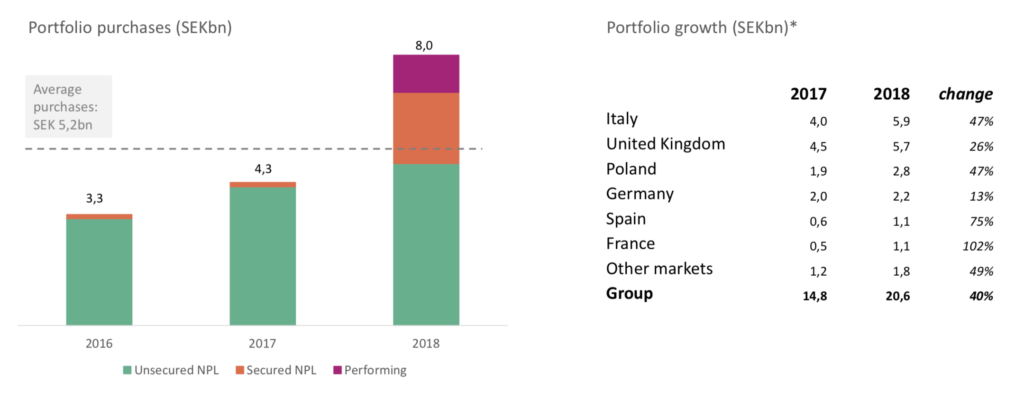

- Key observation #4 - Portfolio carrying value growth of c. 40% yoy in 2018 was met with much more muted increases in P&L metrics - net interest income +5% yoy, Adj EBITDA +11% yoy - suggesting deteriorating return on capital

- Recommendation - Continue to Avoid all Hoist debt securities and Hoist equity

- Key Observation #1 – Hoist’s 180 month remaining gross money multiple (GMM) on portfolios purchased in 2018 was < 1.3x. This means that, even before considering any collection activity or other costs, beyond any profitability contributed in 2018 from these new purchases, these newly purchased portfolios are only expected to generate < 1.3x gross collections over 15 years compared to the portfolio carrying value (the amortised “price paid” for the portfolios)

- Everest Research estimates this remaining GMM on 2018 portfolio purchases by dividing the 2018 yoy change in 180m Estimated Remaining Collections (ERC) of c. SEK 7.4bn by the 2018 yoy change in portfolio carrying value (c. SEK 5.8bn)1

- It is particularly concerning that the remaining GMM is at such a low level on a record year of portfolio purchasing at c. SEK 8bn (more than 2016 and 2017 purchasing combined). Debt purchasers should be investing less (not more) when (net) returns are low in our view

- As a result, Hoist’s overall remaining 180m GMM is now < 1.5x. This is consistent with our projection of all-in net IRRs on portfolios already owned (i.e. after all collection activity and other costs) falling to or below the locked in cost of debt as highlighted in our recent sector-wide report.

- We see a number of explanations as to why the remaining GMM on 2018 purchases was so low:

- Hoist’s ERC excludes performing portfolio purchases (14% of 2018 purchases or c. SEK 1.1bn) whereas its portfolio carrying value includes them

- Hoist extended its accounting cash flow horizon on which its portfolio carrying value is calculated to 15 years from 10 years (increasing portfolio carrying value relative to ERC)

- Hoist’s entry into the performing portfolio purchase market in 2018 may have led to more front loaded collections, so that more of the lifetime net cash generation of the portfolios were realised within 2018

- Hoist may be accepting lower GMMs given its low funding cost (stemming from its deposit access)

- Key Observation #2 – A new regulatory “NPL backstop” is expected to come into effect in Q2 2019 for European banks (and also for Hoist as a regulated credit market company). This would require banks (and Hoist), for regulatory capital purposes, to effectively provision 100% of consumer unsecured NPLs within 3 years of default for loans originated or purchased after implementation of the expected regulation. Whilst this would not affect Hoist until 2022 and would only apply to new portfolio purchases from Q2 2019, this effectively amounts to a risk-weight of 1250% on consumer unsecured NPLs compared to Hoist’s current 150% and, absent mitigating actions, would require a likely terminal c. 8.3x increase in Hoist’s capital requirement on new purchases

- Hoist is looking at investment fund and securitisation structures to mitigate this impact – both involve essentially moving a portion of portfolios outside the regulated credit market company perimeter

- Key Observation #3 – The increase in risk weight on consumer unsecured NPLs from 100% to 150% in December 2018 is being mitigated by Hoist through shifting its purchasing mix into secured and performing portfolios (which bear a much lower risk weight) and by starting the process of moving from the Standardised Approach to the Internal Ratings Based (IRB) Approach (for credit risk capital requirements). IRB model development and supervisory approval is estimated to take 2 to 3 years. The idea is that IRB can potentially deliver significantly lower risk weights than the Standardised Approach

- Hoist is also looking to mitigate this increase in risk weight through securitising portfolios. Investment banks have been mandated to carry out securitisation and Hoist has met with c. 10 investors and had positive feedback. A EUR 500-600m securitisation of the back book is being considered. This will further subordinate senior unsecured bondholders (beyond the subordination they already face to Hoist's depositors). We maintain our Avoid recommendation on all Hoist debt securities and its equity as per our recent note.

- Key observation #4 - Portfolio carrying value growth of c. 40% yoy in 2018 was met with much more muted increases in P&L metrics - net interest income +5% yoy, Adj EBITDA +11% yoy - suggesting deteriorating return on capital. Even adjusting for the accounting difference between 2018 and 2017 (net interest income in 2017 included positive portfolio revaluations and collections outperformance whereas in 2018 revaluations and collections outperformance are shown as a separate line "impairment gains and losses"), net interest income still only increased c. 16% in 2018 compared to the c. 40% increase in portfolio carrying value

Other observations

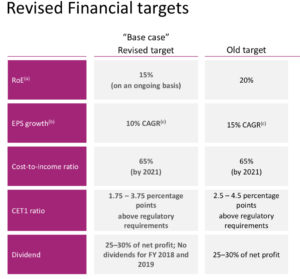

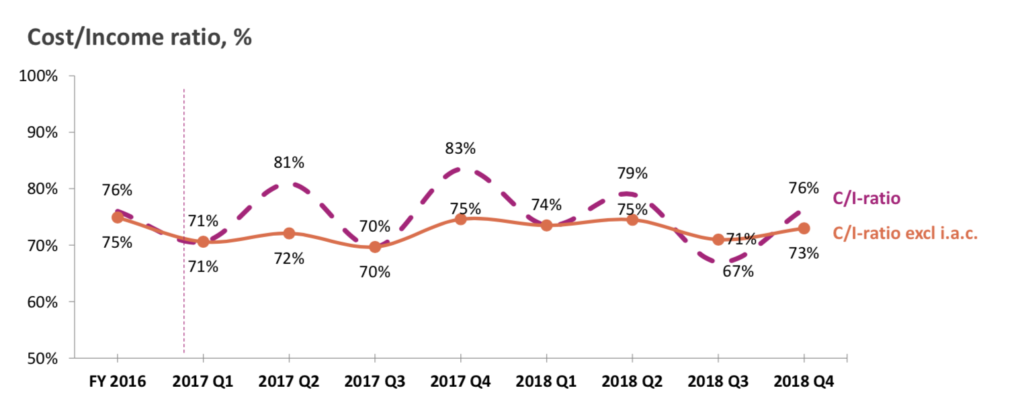

- Where is the operating leverage?! Portfolio carrying value increased 40% yoy in 2018. Yet the underlying cost-income ratio remains stubbornly in the low 70%s, albeit the company would attribute this to “investment” in the platform

- Hoist is guiding towards c. SEK 5bn portfolio purchases in 2019 and growing modestly thereafter if it is able to mitigate against the regulatory headwinds

- There will be no dividend for 2018 and 2019 and financial targets have all been lowered as a result of the regulatory headwinds

- Hoist’s actual to estimated collections came in at 105% for FY 2018 (103% in Q4 2018), the best in 5 years and close to its all-time best performance. We would view this as peak cycle collections outperformance and we remain concerned about how much downside risk there is in the ERC if breakage rates and new payer rates were to revert to levels of 5 to 7 years ago (see our debt purchaser note)

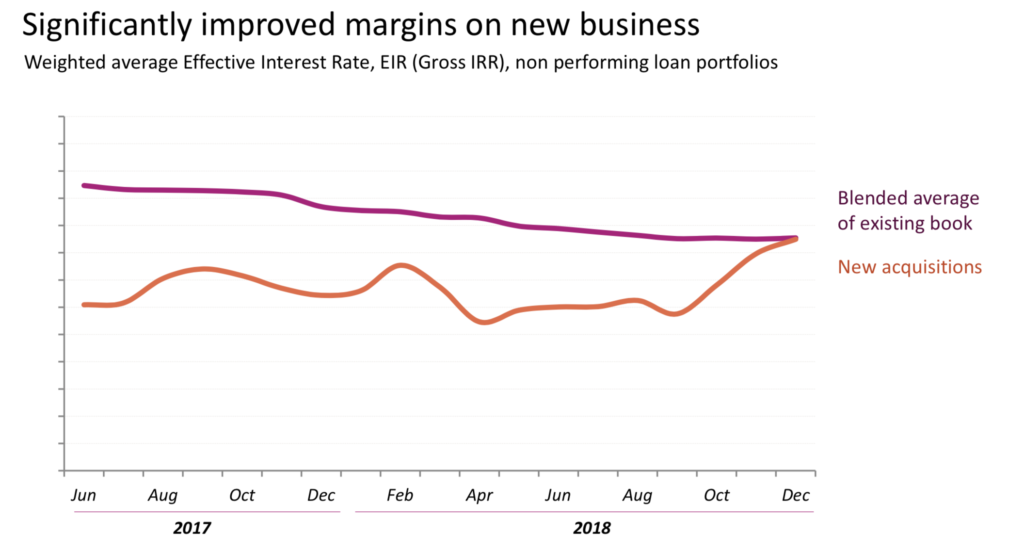

- Gross IRRs on new portfolio purchases increased in late 2018, back up to the level of the overall gross IRR on the entire book. Our own projections based on all-in net IRR, however, reveal a different trend (see our debt purchaser note)

- Digital efforts are showing some success, with 40% of 2018 UK portfolio purchases set up on payment platforms via Hoist’s self-service platform

- Capital headroom to regulatory requirements is at the low end of guidance following the increase in the risk weight on consumer unsecured NPLs to 150% from 100%. CET1 ratio at c. 9.7% compares to a regulatory requirement of c. 7.9%

- Hoist is expecting to close portfolio purchases of c. PLN 400m in Q2 2019 from the defaulted Polish operator Getback (around 1/3 of Getback’s portfolios)

Results Highlights

| METRIC (SEK M) | 2018 | 2017 | % CHANGE | COMMENT |

| Net interest income | 2,435 | 2,329 | +5% |

|

| Total operating income | 2,829 | 2,365 | +20% | |

| Total operating expenses | -2,146 | -1,860 | +15% |

|

| Net operating profit | 683 | 505 | +35% | |

| Adj EBITDA | 3,611 | 3,250 | +11% |

|

| Net debt / Adj EBITDA | 4.5x | 3.6x |

|

|

| Portfolio carrying value | 20,834 | 15,024 | +39% | |

| 120m ERC | 30,733 | 23,991 | +28% | |

| 180m ERC | 33,602 |

Contact Rupesh Tailor at Everest Research to discuss: [email protected]

Everest Research - Deep dive high yield research, distressed debt research and independent equity research

- Hoist did not disclose its 180m ERC at 2017. We estimate this by multiplying the 2017 12om ERC of c. SEK 24.0bn by the ratio of 180m to 120m ERC at Q1 2018 (c. SEK 26.9bn divided by c. SEK 24.7bn). This gives a 180m ERC, as estimated by Everest Research, of c. SEK 26.2bn compared to 180m ERC at 2018 of c. SEK 33.6bn, i.e. an increase of c. SEK 7.4bn. Portfolio carrying value increased from c. SEK 15.0bn at 2017 to c. SEK 20.8bn at 2018, i.e. an increase of c. SEK 5.8bn, albeit Hoist reported the 2017 portfolio carrying value based on a 120m cash flow horizon and the comparative 2018 figure based on a 180m horizon

Categories

Recent Blogs

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 3 March 2020 We published a deep dive last week on Selecta, the European unattended self-service retail market leader, and now see an attractive opportunity to go long risk via both the Senior Secured Notes (SSNs) and 5 …

03 March 2020

Read

OHL. Take Profits Following FY 19 Results

OHL. Take Profits Following FY 19 Results James Moylan & Rupesh Tailor, Everest Research, 28 February 2020 FY 19 results saw negative valuation adjustments on key assets we expect to be sold (Old War Office, London) and alternatively monetised (Canelejas, Madrid) and ongoing uncertainty on the ownership structure. Whilst we remain constructive on OHL’s turnaround (of which there were positive …

28 February 2020

Read

Aldesa. China Railway To Take 75% Stake. CoC Put At 101

Aldesa. China Railway To Take 75% Stake. CoC Put At 101. Buy James Moylan & Rupesh Tailor, Everest Research, 27 December 2019 Aldesa announced late yesterday that, on 25/12/19, it “entered into an investment agreement with CRCC International Investment Group (CRCCII), a wholly-owned subsidiary of China Railway Construction Corporation Limited (CRCC)”, one of the largest construction companies in the world. …

27 December 2019

Read

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 30 October 2019 According to the local newspaper “La Gazzetta di Mantova” (see here), Pro-Gest has been granted a further extension by the Province of Mantua to file its counter-arguments to the rejection of its application for an …