Salini – Pro Forma Net Leverage 2.3x?

05 August 2019

Salini - Pro Forma Net Leverage 2.3x

James Moylan & Rupesh Tailor, Everest Research, 6 August 2019

-

On 2/8/19 Salini announced the launch of “Project Italy” aimed at “strengthening the national sector of public works and construction” (see here). From Salini’s perspective, the major components are: (1) Salini’s own EUR 600m equity raise, now committed; and (2) Salini’s acquisition of a 65% share in Astaldi (an Italian construction firm which is currently in concordato preventivo, a form of Italian insolvency process) for EUR 225m (to be funded out of Salini’s own EUR 600m equity raise), set to complete by mid 2020

-

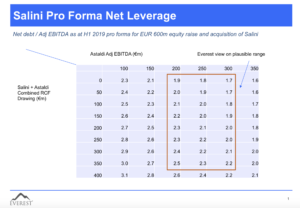

Whilst we look in detail at Salini’s acquisition of Astaldi in our recent note, we highlight here how Salini’s net leverage will look pro forma for the now confirmed EUR 600m equity raise and Salini’s investment of EUR 225m thereof in Astaldi. Our central case is that pro forma net leverage (as at H1 2019 on an LTM basis) would be 2.3x net debt / Adj EBITDA, with a plausible range of 1.7x to 2.5x (down from Salini’s 3.8x at H1 2019 and keeping in mind that leverage is around 0.5x turns lower at the FY stage). Our net leverage figures exclude non-cash financial assets from net debt and therefore differ from figures presented by Salini

-

Simplistically, Salini’s pro forma net leverage will be reduced by: (1) the net EUR 375m of its equity raise retained after its investment in Astaldi; and (2) the full consolidation of Astaldi’s EBITDA (Astaldi will be acquired on a debt free basis). Key uncertainties, however, are: (1) the extent to which Astaldi’s EBITDA has fallen since it last reported in Q1 2018; and (2) how much of the new committed RCFs for Salini and Astaldi (each will have its own EUR 200m RCF) will be drawn down? We look at both these factors in our note

-

Our central pro forma net leverage estimate assumes that: (1) EUR 200m in total would be drawn across both Salini’s and Astaldi’s EUR 200m RCFs (each will have its own EUR 200m RCF, as committed by credit institutions); and (2) Astaldi’s annual EBITDA is EUR 200m

-

Astaldi has not reported financial statements since Q1 2018, at which stage its LTM core EBITDA was EUR 324m. We believe there will have been some shrinkage in this, owing to Astaldi likely being behind schedule on some of its contracts or potentially even some of them having been terminated. We are also unsure what performance guarantees may have been triggered by Astaldi’s clients and would there be any scope for such guarantees to be triggered post an acquisition by Salini. It may also be that a portion of the net EUR 375m equity raised by Salini after its investment in Astaldi needs to be used in working capital to get Astaldi back on schedule with its construction contracts

-

We show in the table below this blog the sensitivity of Salini’s H1 2019 LTM pro forma net leverage to: (1) Astaldi’s EBITDA; and (2) drawings under Salini’s and Astaldi’s RCFs. Our sensitivity table assumes the net EUR 375m of equity raised is kept as cash (rather than needed to invest in working capital at Astaldi)

-

We maintain our Avoid recommendation on Salini’s senior unsecured bonds (EUR 1.75% 10/24 trading at a price of 86.98, YTW 4.6%, Z+499, up around 1/8th of a point following the launch of Project Italy) and equity (share price EUR 1.89, market cap c. EUR 940m, +2.7% on the news) where we have viewed both the equity raise and Astaldi acquisition as largely priced in following the recovery in the bonds from price lows of c. 63.40

H1 2019 Results

- Salini also reported H1 2019 results mid last week. These results were modestly positive in our opinion, particularly with respect to: (1) new orders (H1 2019 c. EUR 6.1bn); and (2) Adj EBITDA (EUR 239m including a pro rata share of unconsolidated JVs as reported by Salini versus our estimated EUR 203m and H1 2018 216m), particularly the turnaround in Lane Group (US) EBITDA from historically negative to positive in H1 2019 (H1 2019 +EUR 17m vs our estimate -EUR 12m and H1 2018 -EUR 40m)

- New orders were supported by c. EUR 3.2bn coming from Snowy 2.0 Hydropower in Australia. The turnaround in Lane benefitted from the “Overhead Restructuring” plan (c. EUR 30m cost savings pa) and we note also the c. 32% yoy increase in Lane’s revenue as suggestive of a business that may be seeing some scale benefit. Salini confirmed its long run EBIT margin target of 3% for Lane

- Cash flow from working capital was also better than in prior H1s and versus our estimate (H1 2019 c. -EUR 101m vs our estimate -EUR 400m and H1 2018 c. -EUR 421m). Impressively, the better-than-expected H1 2019 working capital cash outflow also included one-off outflows of EUR 123m for reimbursement of a Panama contract and a EUR 60m tax payment on the Plant & Pavings business disposal. Excluding these, H1 2019 working capital would contributed a seasonally atypical inflow of EUR 82m. Whilst management commentary pointed to advance payments on the very high H1 2019 new orders being a key factor in H1 2019 working capital cash flow, we note that within working capital components, the big inflow came in trade payables (+EUR 262m) and not from a change in contract liabilities

- As explained in more detail in our note, contracts assets and liabilities are measured as: + amount of work performed calculated using the cost-to-cost method pursuant to IFRS 15 - progress payments and advances received - contractual advances. Where this figure is positive, the contract is shown as a contract asset on the balance sheet; where negative it is shown as a contract liability. Therefore we would expect higher advance payments from customers on new orders to show up as an increase in contract liabilities on balance sheet and correspondingly a working capital cash inflow, However, contract liabilities generated a cash outflow of c. -EUR 35m in H1 2018, which we struggle to reconcile with management commentary on increased advance payments. We do note that Snowy 2.0 Hydropower contributed EUR 166m of contract liabilities which, given that we understand work has not yet started on this project, would likely be one such advance payment. We will monitor closely Salini’s working capital in subsequent reporting periods. We also struggle to understand how, in spite of working capital coming in c. EUR 0.3bn better than is seasonally typical, net debt was slightly higher at H1 2019 (c. EUR 1,588m vs EUR 1,523m at H1 2018 and EUR 1,313m at 2018)

- Net leverage (excluding non-cash financial assets) came in at 3.8x at H1 2019 on an LTM basis, versus our expected 3.9x (the beat coming from higher EBITDA). The trend in net leverage has remained upward, notwithstanding the pending equity raise. Net leverage had been 0.8x in 2015 and 1.2x in 2016 which provided the backdrop for Salini’s bond issuance in 2016 and 2017

Equity Raise & New Financing Facilities

- On 2/8/19, Salini announced (subject to fulfilment of certain unspecified conditions precedent) that it had received underwriting commitments for its EUR 600m equity raise, the split of which is as follows: CDP Equity EUR 250m; Financing Banks EUR 150m; Salini Costruttori (family-owned entity) EUR 50m; and Joint Global Co-ordinators EUR 150m for the portion of the equity raise targeted at the market

- Salini and Astaldi will each have new RCFs of EUR 200m (in Astaldi’s case following completion of its own capital raise of EUR 225m from Salini). Astaldi will also benefit from new bonding facilities of EUR 385m to facilitate continuity of its operations. Salini will also benefit from extension of maturity on some EUR 170m of its existing debt and a new EUR 150m cash credit facility to “support cash requirements during interim period”

Contact Rupesh Tailor at Everest Research to discuss: rupesh.tailor@everestresearch.co.uk

Everest Research - Deep dive high yield research, distressed debt research and independent equity research

Categories

Recent Blogs

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 3 March 2020 We published a deep dive last week on Selecta, the European unattended self-service retail market leader, and now see an attractive opportunity to go long risk via both the Senior Secured Notes (SSNs) and 5 …

03 March 2020

Read

OHL. Take Profits Following FY 19 Results

OHL. Take Profits Following FY 19 Results James Moylan & Rupesh Tailor, Everest Research, 28 February 2020 FY 19 results saw negative valuation adjustments on key assets we expect to be sold (Old War Office, London) and alternatively monetised (Canelejas, Madrid) and ongoing uncertainty on the ownership structure. Whilst we remain constructive on OHL’s turnaround (of which there were positive …

28 February 2020

Read

Aldesa. China Railway To Take 75% Stake. CoC Put At 101

Aldesa. China Railway To Take 75% Stake. CoC Put At 101. Buy James Moylan & Rupesh Tailor, Everest Research, 27 December 2019 Aldesa announced late yesterday that, on 25/12/19, it “entered into an investment agreement with CRCC International Investment Group (CRCCII), a wholly-owned subsidiary of China Railway Construction Corporation Limited (CRCC)”, one of the largest construction companies in the world. …

27 December 2019

Read

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 30 October 2019 According to the local newspaper “La Gazzetta di Mantova” (see here), Pro-Gest has been granted a further extension by the Province of Mantua to file its counter-arguments to the rejection of its application for an …