Thomas Cook – c. £1.9bn Base Case Break-Up Enterprise Value

10 June 2019

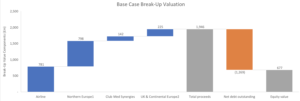

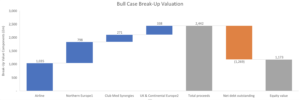

Thomas Cook - c. £1.9bn Base Case Break-Up Enterprise Valuation

Rupesh Tailor, Everest Research, 10 June 2019

- As per our note from last week, we see a going-concern break-up of Thomas Cook as more likely than a near term administration or CVA. Our base case break-up enterprise valuation (see/expand charts below) of Thomas Cook comes out at c. £1.9bn, leaving £677m equity value or £0.44 per share compared to the current share price at c. £0.19 per share. Our bull case break-up enterprise valuation is at c. £2.4bn, valuing the shares at c. £0.76 per share

- Specifically, we see a break-up into all or some of the following constituent parts (some of which may themselves be broken up further): (1) the Group Airline (potentially excluding Thomas Cook Airlines Scandinavia A/S); (2) the Northern European business (both the tour operator and airline businesses), for which private equity firm Triton has submitted a bid; and (3) the remaining UK and Continental Europe tour operator businesses (Fosun is in discussions currently to acquire the Group Tour Operator business)

- We have valued the synergies between Fosun's Club Med business and Thomas Cook's Group Tour Operator business based on Thomas Cook's distribution capability increasing Club Med's occupancy rate to (eventually) 72% (from 66% in 2018) in our base case and to (eventually) 78% in our bull case and the resulting increase in our DCF valuation of Fosun Tourism Group's (FTG) Club Med business (which FTG reports under as its "Resorts" segment)

- As per our note, other top European sun and beach hotel operators are able to achieve occupancy rates of up to high 80%s even over a full year, e.g. Tui's Riu hotels achieved 89% occupancy over FY 2018. However, 19% of Club Med's capacity (as measured by number of beds) comes from "Mountain" resorts which are essentially ski resorts and, in our view, will always be constrained in the full year occupancy rate they can achieve. 78% in our bull case represents our view as to the maximum occupancy rate Club Med can achieve over a full year given its mix of resorts across "Sun" and "Mountain" categories. We assume in our Thomas Cook break-up values below that Fosun "pays" 50% of the synergies to Thomas Cook through the price it may pay for Thomas Cook's Group Tour Operator. The full synergies we estimate for FTG's Club Med business are £284m in our base case and £543m in our bull case

- For more details on the Club Med / Thomas Cook combination rationale and our valuation of the other parts of the Thomas Cook Group, please see our note from last week

- "Northern Europe" refers here to both Thomas Cook's Northern European tour operator and airline businesses. Consequently, "Airline" in the charts refers to the Group Tour Operator excluding Thomas Cook's Scandinavian airline

- "UK and Continental Europe" in the charts refers only to Thomas Cook's UK and Continental European tour operator business, excluding its UK and German airline businesses

Contact Rupesh Tailor at Everest Research to discuss: rupesh.tailor@everestresearch.co.uk

Everest Research - Deep dive high yield research, distressed debt research and independent equity research

Categories

Recent Blogs

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 3 March 2020 We published a deep dive last week on Selecta, the European unattended self-service retail market leader, and now see an attractive opportunity to go long risk via both the Senior Secured Notes (SSNs) and 5 …

03 March 2020

Read

OHL. Take Profits Following FY 19 Results

OHL. Take Profits Following FY 19 Results James Moylan & Rupesh Tailor, Everest Research, 28 February 2020 FY 19 results saw negative valuation adjustments on key assets we expect to be sold (Old War Office, London) and alternatively monetised (Canelejas, Madrid) and ongoing uncertainty on the ownership structure. Whilst we remain constructive on OHL’s turnaround (of which there were positive …

28 February 2020

Read

Aldesa. China Railway To Take 75% Stake. CoC Put At 101

Aldesa. China Railway To Take 75% Stake. CoC Put At 101. Buy James Moylan & Rupesh Tailor, Everest Research, 27 December 2019 Aldesa announced late yesterday that, on 25/12/19, it “entered into an investment agreement with CRCC International Investment Group (CRCCII), a wholly-owned subsidiary of China Railway Construction Corporation Limited (CRCC)”, one of the largest construction companies in the world. …

27 December 2019

Read

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 30 October 2019 According to the local newspaper “La Gazzetta di Mantova” (see here), Pro-Gest has been granted a further extension by the Province of Mantua to file its counter-arguments to the rejection of its application for an …