Thomas Cook – Fosun, Anex Or Bust?

07 August 2019

Thomas Cook - Fosun, Anex Or Bust?

Rupesh Tailor, Everest Research, 7 August 2019

- Thomas Cook’s share price has risen 2.2x over the past 5 trading sessions to stand now at c. 9.9p per share (market cap c. £152m). This rally coincided with the first time disclosure on 30/7/19 of a stake in Thomas Cook held by the Turkish investor, Mr Neset Kockar, that now stands at c. 8%. Mr Kockar is the founder, owner and chairman of Anex Tourism Group (“Annex Tour”), an integrated tour operator with airline business (Azur Air, acquired in late 2015) operating in Russia, Belarus, Ukraine, Kazakhstan and Germany and also, under the Orex Travel brand, in the Czech Republic, Slovakia and Poland

- Mr Kockar has, as yet, not made clear his intentions regarding his stake in Thomas Cook, simply noting: “We believe Thomas Cook has more value and potential than what is being discussed recently, particularly with the skillset and complementary capabilities Anex Tour shall put forward. We are keen to explore further the potential strategic initiatives related to Thomas Cook and engage with the relevant stakeholders”

- With over 2 million Russian outbound customers per year (c. 3 million across all of Anex’s markets), Anex is a leading tour operator in Russia. Crucially, one third of Anex’s Russian customers book holidays in Turkey, a destination market in which Thomas Cook has a strong hotel offering (50 own brand hotels, c. 27% of its total own brand hotels, when last disclosed in 2017 and we expect this number to have modestly increased since then)

- We believe a key part of the “complementary capabilities” that Mr Kockar referred to is the ability of Anex to drive visitors to Thomas Cook’s own brand hotels in Turkey, as well as to potentially help Thomas Cook expand its own brand hotel portfolio in Turkey with some level of visibility on expected traffic from Russian tourists

- We note that Thomas Cook itself had stated as a driver for its announced acquisition (through a JV with Ionic Invest) in H1 2019 of Biblio Globus (one of Russia’s largest tour operators with c. 3 million customers) that its “own brand hotels will profit from a larger customer base in the Eastern Mediterranean", which we believe was a specific reference to Biblio Globus’ ability to channel Russian tourists to Thomas Cook’s own brand hotels in Turkey

- Turkey is the most popular destination for outbound Russian tourists with an estimated c. 6m visits out of a total c. 44.7m outbound trips by Russian tourists in 2018 (c. 13% share for Turkey as a destination). Turkey as a destination for outbound Russian tourists is also growing faster (+24% in 2018) than the overall Russian outbound market (+13%)

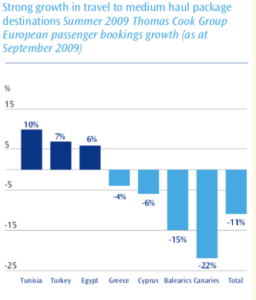

- We see a good fit between Thomas Cook’s customer offering (in Turkey as well as in other destination markets) and Russian tourists. As per Everest’s price comparison analysis in our note, Thomas Cook competes well at lower price points for package holidays, particularly in Turkey. This aligns well with the relatively low average spend per person of Russian tourists on package holidays of c. RUB 55,000 in 2018 (c. £692 per person or c. £2,750 for a family of four). We also note that Thomas Cook expected Turkey to be its number 2 destination for summer 2019 (after Greece and treating Mainland Spain, the Balearics and the Canaries as separate destinations). Turkey (and Tunisia and Egypt) also showed its (their) value credentials in the economically challenged summer 2009, with Thomas Cook’s bookings to Turkey up 7% yoy in summer 2009 vs all other main markets (besides the other value destinations of Egypt and Tunisia) shrinking at the time (see figure below)

- A second major incentive we believe for Mr Kockar and Anex Tour to engage in “potential strategic initiatives related to Thomas Cook” would be to benefit from Thomas Cook’s online and mobile app presence and know-how which will become increasingly important in the Russian market. Online sales of holiday packages were estimated at only 3% to 5% of total holiday package sales in Russia in 2016, though this is expected to grow significantly moving forward. Whilst we view Thomas Cook as lagging the likes of Tui and On The Beach in terms of popularity of its website and mobile app, we believe it still likely has expertise here that will be useful as the Russian market moves increasingly online

- Whilst we can see potential synergies between Anex Tour and Thomas Cook, particularly with respect to Russia-to-Turkey tourism, we are unsure how Mr Kockar plans to stabilise Thomas Cook’s financial position such that it is able to sustainably engage in strategic initiatives with Anex Tour. We are unable to find any meaningful financial statements or data for Anex Tour or net worth information on Mr Kockar that would give an idea as to their ability to either acquire Thomas Cook in its entirety and recapitalise it or to co-invest in the recapitalisation plan contemplated by Fosun (see our note on the Fosun-led recapitalisation and restructuring plan)

- In the absence of financial information on Anex Tour and / or Mr Kockar, our current base case is that a Fosun-led recapitalisation and debt restructuring of Thomas Cook will proceed but we welcome the possibility for Thomas Cook’s “more value and potential than what is being discussed recently” to be achieved through Mr Kockar’s involvement. We set out in our note our expectations for the value of post-reorganisation equity in Thomas Cook’s Tour Operator and Airline which we expect bondholders to receive (in a Fosun-led recapitalisation and restructuring) as well as any (limited) new debt which they may also receive

- As per our note, we estimate a near-term “recovery” rate based on the initial value of post-reorganisation equity and 2nd lien secured bonds of 60% in our base case (4% in our stress case but more likely 30%-40% in our realistic stress case). We estimate a longer-term “recovery” rate based on our estimated value of post-reorganisation equity and 2nd lien secured bonds in 2023 (post a turnaround facilitated by the injection of new money under the recapitalisation) of 144% in our base case (30%-40% in our realistic stress case and 345% in our bull case)

- The key components of a turnaround (covered extensively in our previous note) are, we believe: (1) growing the own brand hotel estate (particularly managed hotels); (2) accelerating online channel shift (reducing distribution through stores in favour of online distribution; increasing dynamic packaging); and (3) growing the complementary Expedia business (whereby Thomas Cook offers Expedia’s city hotels on its platform). (1) and (2) in particular require new money which we believe the planned recapitalization through Fosun would provide

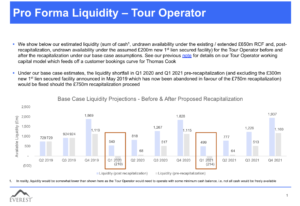

- In the event that neither the Fosun-led recapitalisation and restructuring of Thomas Cook nor Mr Kockar’s plans come to fruition, as per our note, and as illustrated below, we project a liquidity shortfall for Thomas Cook of c. £210m in Q1 2020 (i.e. December 2019), particularly as the previously announced new £300m 1st lien secured facility has now been put on hold. As explained in our original note, our liquidity projections feed off our working capital model for Thomas Cook that models working capital based off a monthly bookings curve for summer and winter seasons that takes various data points from Thomas Cook’s disclosure at various points and supplemented with bookings curve data from On The Beach. This model very accurately predicts Thomas Cook’s own disclosed intra-year liquidity fluctuations over the years

- A key question that has come up in our discussions with investors has been why, in our restructuring scenario, we assume that, whilst Thomas Cook’s senior unsecured bonds will be substantially converted to equity (at effectively a significant haircut to par, at least initially), its senior unsecured (pari passu) RCF will not be equitised (despite Thomas Cook’s press release of 12/7/19 stating “The proposal envisages that a significant amount of the Group’s external bank and bond debt will be converted into equity, to be agreed following discussions with financial creditors”, our emphasis in italics)

- Our view here is that, post any Fosun-led recapitalisation and restructuring, Thomas Cook will need a significantly more sizeable credit facility than the perhaps c. £300m facility envisaged within the £750m recapitalisation. Thomas Cook’s liquidity need essentially increases c. £1.2bn from Q4 to Q1 seasonally (see our note) and, whilst much of this is typically met with cash built up in Q4, Thomas Cook will likely still need an RCF of comparable size to the £650m RCF it has today (excluding the £225m bonding facility) post-restructuring. If current RCF lenders are to be equitised, we believe it may be difficult to find new RCF lenders and that bondholders would ultimately be better off owning a larger share of post-reorganisation equity in the Tour Operator and Airline than if this is shared with current RCF lenders. We believe bondholders and RCF lenders will eventually agree that bondholders will take a larger share of equity and that the RCF lenders will continue to make an RCF (of similar size to today’s) available to Thomas Cook post restructuring

- We maintain our buy recommendation on Thomas Cook’s senior unsecured EUR 6.25% 2022 bonds (current price 30.70). The next major (known) event of significance is Tui's Q3 results due next week (on 13/8/19) which should give a good read on the state of summer 2019 market conditions in the European tour operator market

Contact Rupesh Tailor at Everest Research to discuss: [email protected]

Everest Research - Deep dive high yield research, distressed debt research and independent equity research

Categories

Recent Blogs

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps

Selecta. Going Long SSNs At 95.375 (7.2% YTW) & Selling 5y CDS At 474bps Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 3 March 2020 We published a deep dive last week on Selecta, the European unattended self-service retail market leader, and now see an attractive opportunity to go long risk via both the Senior Secured Notes (SSNs) and 5 …

03 March 2020

Read

OHL. Take Profits Following FY 19 Results

OHL. Take Profits Following FY 19 Results James Moylan & Rupesh Tailor, Everest Research, 28 February 2020 FY 19 results saw negative valuation adjustments on key assets we expect to be sold (Old War Office, London) and alternatively monetised (Canelejas, Madrid) and ongoing uncertainty on the ownership structure. Whilst we remain constructive on OHL’s turnaround (of which there were positive …

28 February 2020

Read

Aldesa. China Railway To Take 75% Stake. CoC Put At 101

Aldesa. China Railway To Take 75% Stake. CoC Put At 101. Buy James Moylan & Rupesh Tailor, Everest Research, 27 December 2019 Aldesa announced late yesterday that, on 25/12/19, it “entered into an investment agreement with CRCC International Investment Group (CRCCII), a wholly-owned subsidiary of China Railway Construction Corporation Limited (CRCC)”, one of the largest construction companies in the world. …

27 December 2019

Read

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy

Pro-Gest – Deadline To File Counter-Arguments On Mantua Plant Increased EIA Authorization Extended. Buy Massimiliano Zanetti Bottarelli & Rupesh Tailor, Everest Research, 30 October 2019 According to the local newspaper “La Gazzetta di Mantova” (see here), Pro-Gest has been granted a further extension by the Province of Mantua to file its counter-arguments to the rejection of its application for an …